Business FirstLow Cost of Doing Business

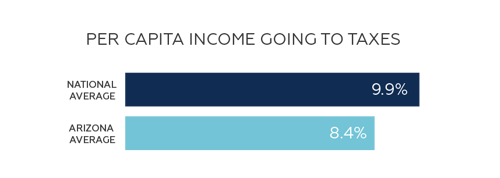

Arizona offers one of the lowest costs of doing business in the United States, primarily because of low taxes and small state government. While the national average of per-capita income going to taxes is 9.9 percent, here the number is only 8.4 percent. In addition, Arizona's taxes on property, gas and personal income remain low compared to the rest of the country.

GOVERNMENT EFFICIENCY

Considering the size of the population, the state government is small. In fact, Arizona has the country's second-lowest number of state and local government employees per 100 residents, according to a 2014 study by the Beacon Hill Institute. That study also ranked Arizona ninth in the nation for government and fiscal policy, which results in a significantly low cost of doing business.

When the Small Business and Entrepreneurship Council reviewed Arizona in 2013, it noted the competitive tax reductions enacted, which reduce business costs for companies expanding, moving or starting up in the state. Property taxes here are the sixth-lowest in the country, and unemployment insurance tax is the fourth-lowest. Average costs for workers compensation are another advantage, with Arizona ranked 14th lowest nationwide by the American Legislative Exchange Council in 2015.